Share Buybacks vs Dividends: Who wins?

4 minute read | Dec 23, 2023

finance

When it comes to returning capital to shareholders, dividends are the clear winner over share buybacks. While buybacks often serve short-term executive goals, dividends provide a more transparent and consistent return to shareholders.

A share buyback, where a company acquires and cancels its own shares, increases the ownership percentage of remaining shareholders. However, these buybacks are frequently motivated by the desire to enhance executive KPIs, such as share price and earnings per share, rather than long-term shareholder value.

Sections

- Share buyback vs dividends: Impact on shareholder value

- After-tax returns: Share sales vs dividends

- Incentive alignment: Executives and shareholders

1. Share buyback vs dividends: Impact on shareholder value

The common but incorrect argument favoring buybacks over dividends is that they boost earnings per share and the valuation of the company.

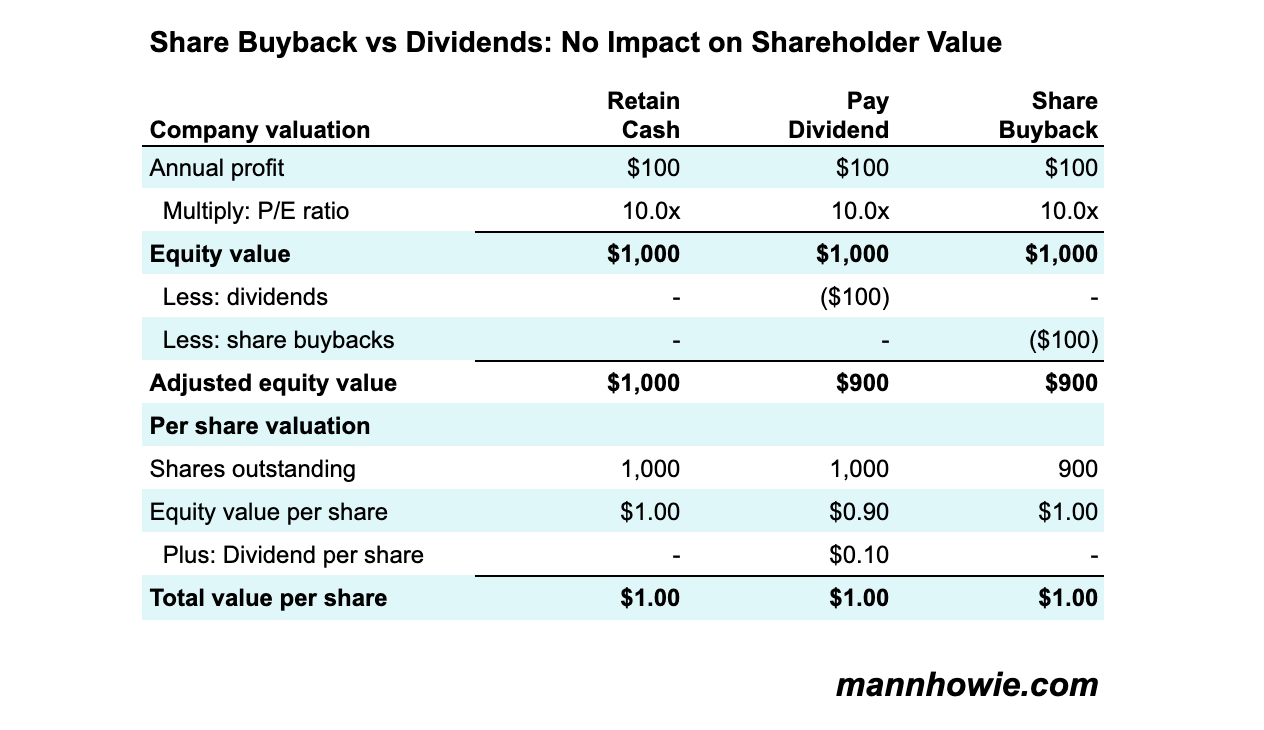

The overall equity valuation of a company is unaffected by its choice to execute a share buyback or distribute dividends. Let’s explore this with an example of a company with $100 profit, a PE ratio of 10x, and decision to distribute the profit as dividend or buyback:

- Retaining Cash: The company's equity valuation remains at $1,000, with a total of 1,000 shares outstanding, each priced at $1.00.

- Paying Dividends: When a dividend of $0.10 per share is paid out, the equity valuation decreases by the dividend amount, and the share price adjusts to $0.90. The overall value to the shareholder, however, stays at $1.00 per share, combining a $0.90 share value with a $0.10 cash dividend.

- Conducting a Share Buyback: The equity valuation decreases by the buyback amount of $100. After purchasing shares at $1.00 each, the share count reduces to 900. The remaining shareholders' equity value per share stays constant at $1.00.

Market timing in buybacks

As share buybacks are a human decision, they tend to occur when market sentiment is buoyant and there is surplus cash on hand. This can hurt shareholders, when companies repurchase overvalued stock and deplete funds needed for future business growth.

The argument that companies should buyback shares when it is trading below intrinsic value assumes management has perfect knowledge of the intrinsic value of the company. If this were true they should immediately retire, mortgage their house and go all in on the stock.

2. After-tax returns: Share sales vs dividends

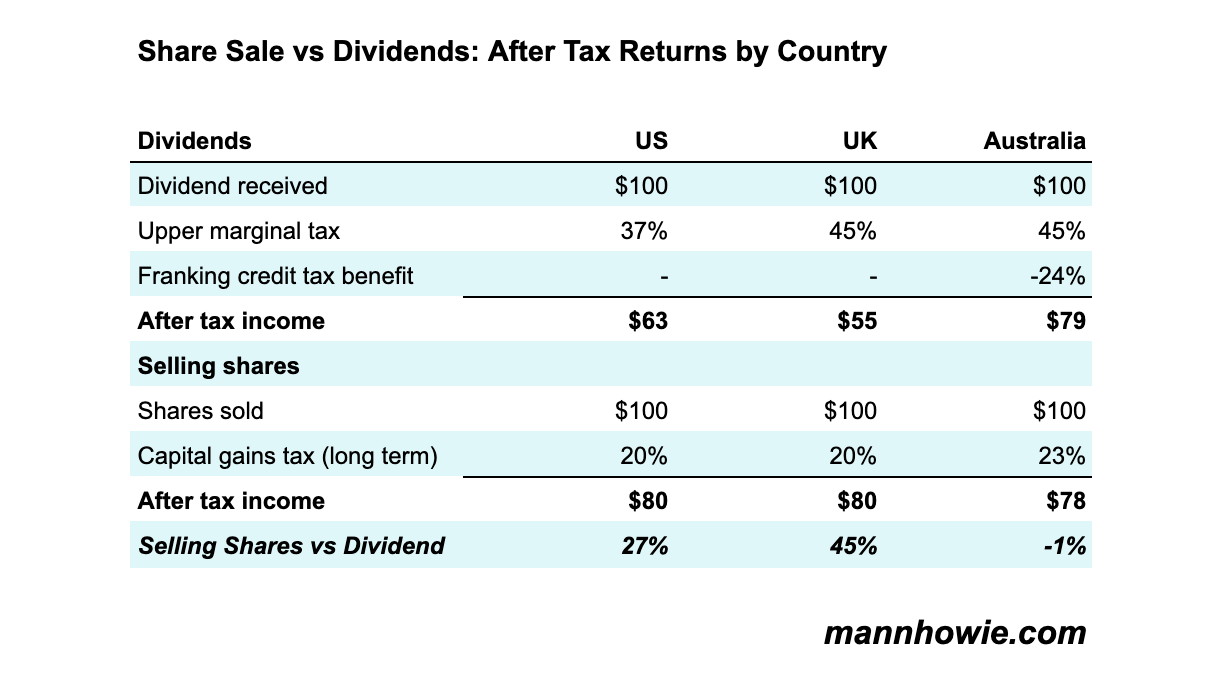

Another common argument favoring share buybacks is their tax efficiency. Dividends are taxed at the recipient's marginal rate, whereas profits from share sales, including those from buybacks, are often subject to the lower long-term capital gains tax.

The table below compares the after tax return of receiving $100 in ordinary cash dividends vs selling $100 worth of shares held for longer than 12 months. In countries like the US and UK there can be a material after tax benefit in realising value from capital gains vs cash dividends.

Tax effective alternatives

However, it's important to recognize that this tax benefit is not unique to buybacks but extends to all capital gains. A shareholder is still able to tax effectively sell a portion of their shareholding at anytime if they believe the shares are overvalued.

In places like Australia, dividend franking credits are used to avoid double taxation of company profits. As a result, Australia has amongst the highest dividend payout ratios in the world.

If tax efficiency were the sole rationale, companies might prefer pro-rata off-market buybacks, allowing all shareholders to participate instead of large institutions and hedge funds which dominate the volume of shares traded. Yet, the prevalent practice is on-market buybacks aimed at boosting share prices.

3. Incentive alignment: Executives and shareholders

Charlie Munger’s famous quote, “Show me the incentive and I’ll show you the outcome” highlights the importance of aligning executive and shareholder interests.

Warren Buffet proposes several principles for better alignment:

- Favoring cash bonuses based on business performance rather than stock options dependent on share price.

- Encouraging earnings on additional capital that surpass defined hurdle rates, like Return on Invested Capital.

- Focusing on revenue and profitability metrics, such as revenue, EBIT and free cash flow targets.

- Setting goals based on operational milestones that reflect long-term performance.

Share buybacks when used judiciously and not solely in order to promote executive incentives can still be an effective way of enhancing shareholder value. As Warren Buffet famously said

Picking the right CEO is 10 times more important than the compensation.

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.