How Much is Alibaba Worth? US$900 billion in 2021

8 minute read | Jun 4, 2021

finance

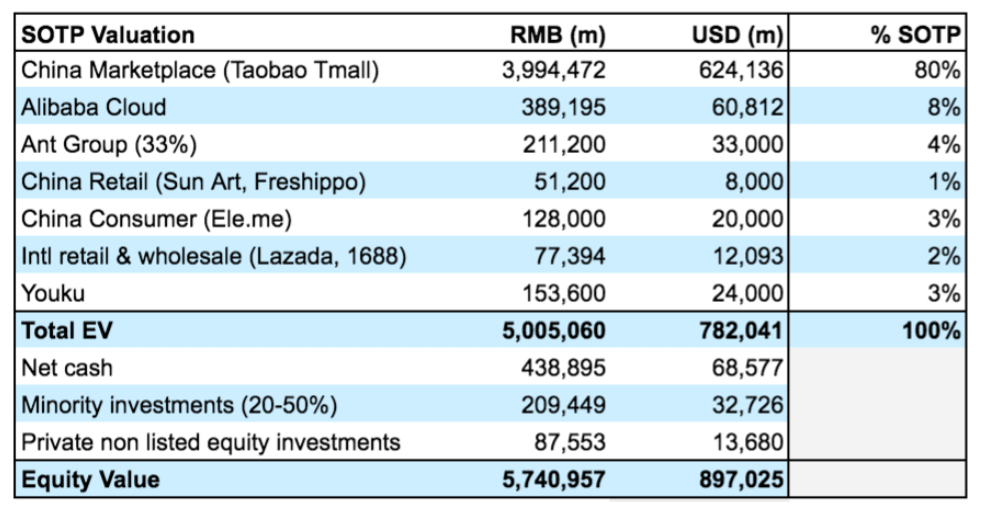

Alibaba operates three of the largest digital platforms in China: e-commerce, cloud and payments. We estimate Alibaba Group (BABA:NYSE 9988:HKG) to be valued at up to US$900 billion based on a Sum Of The Parts (SOTP) valuation of its various operating segments:

Alibaba Group SOTP Valuation (2021)

This article analyses Alibaba’s two main operating segments that represent up to 88% of the group valuation (Taobao/ Tmall and Alibaba Cloud) and shows how you can formulate your own valuation and thesis. To learn the fundamentals of valuing any technology company refer to this article with a case study of how to value YouTube.

Key Sections:

1. China E-Commerce Market Share

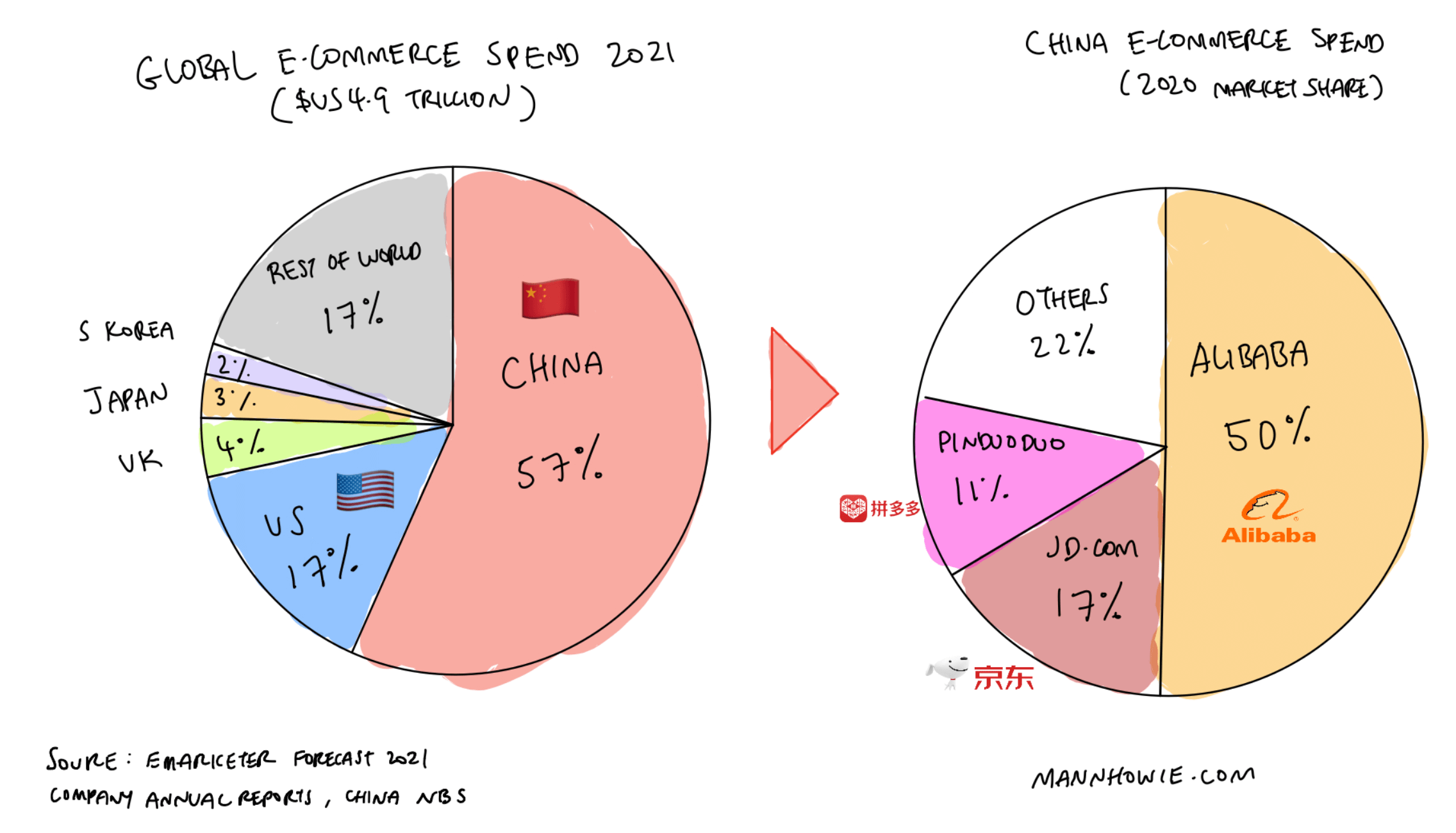

China dominates global online spending. Over 57% of total global online spend happens in China with an estimated +1 billion online shoppers spending over US$2.8 trillion annually. Online spending in China alone is more than 70% more than the next 10 countries combined.

Global E-Commerce Spend by Country (2021 Forecast) & China E-Commerce Market Share by Company (2020 Actual)

China is likely to continue to dominate global online spending the next decade and beyond. Relative to the United States, China has 5x the online shopping population and is still only at 20% of US GDP and Income per capita. Across e-commerce there are two economies: China and the Rest of the World.

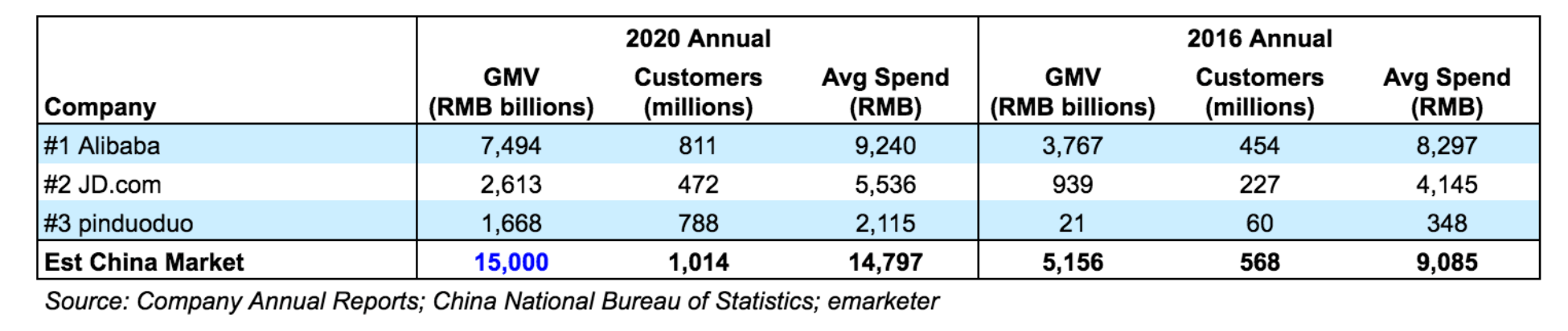

Within China, e-commerce is dominated by three players: Alibaba, JD.com and Pinduoduo. Alibaba’s annual Gross Merchandise Value (GMV) across its two platforms Taobao and Tmall in China alone is more than all annual online spend across the US, UK and Japan combined.

China E-Commerce Major Players

Across the three major Chinese players Alibaba maintains its dominant position. However newcomer pinduoduo has grown considerable share in a very short period focusing on a new trend in e-commerce in China, lower basket value social commerce.

Across the three major Chinese players Alibaba maintains its dominant position. However newcomer pinduoduo has grown considerable share in a very short period focusing on a new trend in e-commerce in China, lower basket value social commerce.

2. Taobao / Tmall Valuation

Alibaba’s largest and most profitable segment is its e-commerce marketplace platform in China known as Taobao and Tmall. We value this segment at RMB 4 trillion (US$ 624 billion) representing 80% of the entire valuation of Alibaba.

What is Taobao and Tmall?

With over 811 million active annual customers, Taobao is effectively the internet platform for e-commerce in China. Nearly all merchants and businesses that sell to Chinese consumers have an online store on Taobao.

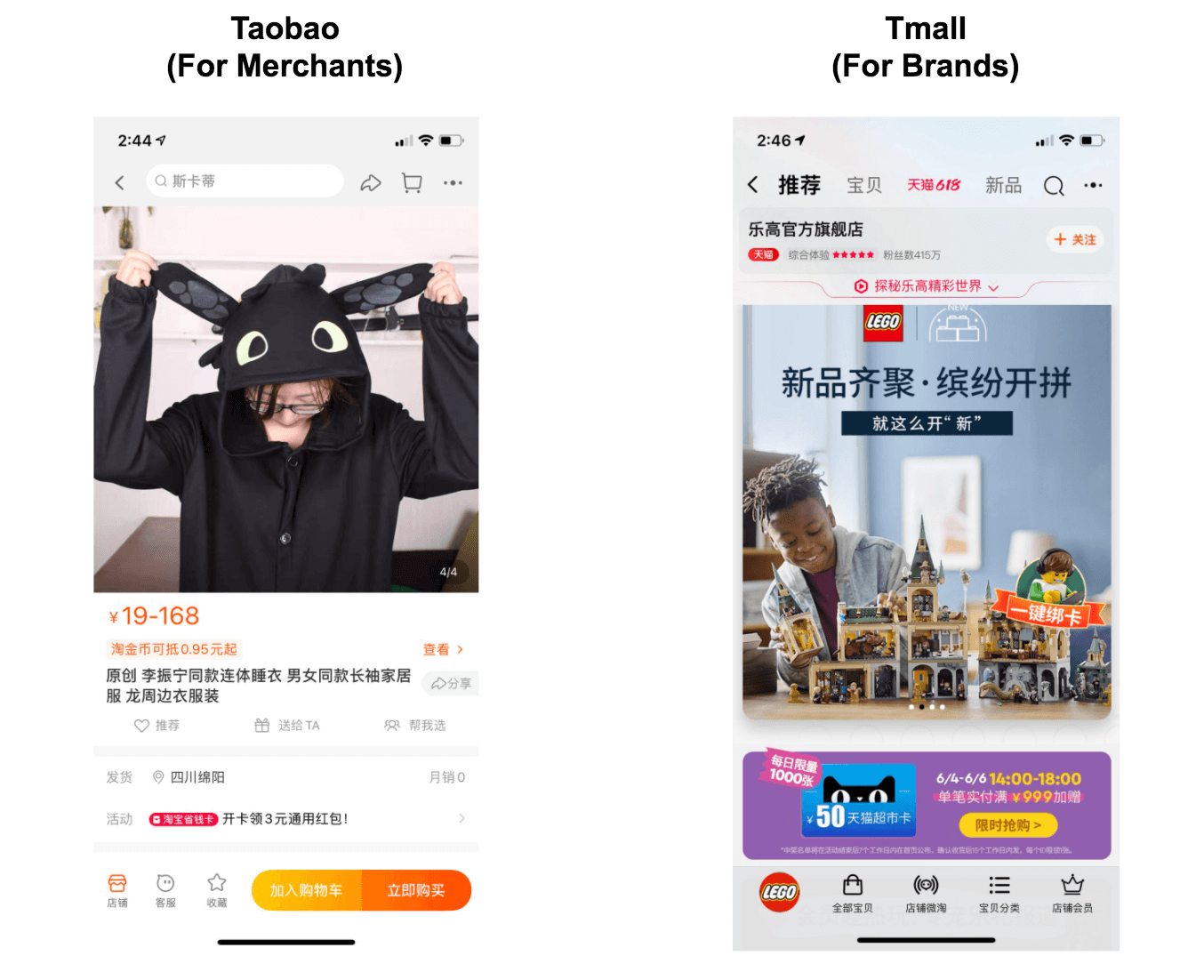

There are two main platforms within the one Taobao mobile and web app: Taobao and Tmall with a total GMV split 50/50:

-

Taobao is a marketplace platform where any merchant, person or small business can set up an online store and sell to the Chinese population.

-

Tmall is a B2C platform reserved for brand companies where they can set up their own dedicated stores. Most international brands selling into China will transact through their Tmall stores vs their own online shops.

Taobao vs Tmall

Alibaba’s e-commerce business model is marketplace-based and facilitates transactions between buyers and sellers. Unlike Amazon and JD.com, Alibaba does not purchase and resell inventory nor does it own or operate its own fulfilment and distribution centres. It is the sellers responsibility for organising delivery to the buyer either direct or via Alibaba’s network of 3rd party logistics providers (via its global Cainiao logistics business).

How does Taobao Tmall generate revenue?

Ads and commissions:

-

Ads (70% of e-commerce revenue): merchants buy keywords and display ads on Taobao and Tmall to attract traffic and purchases to their stores. Ad monetization represents 2-3% of GMV transacted through the platform. Alibaba’s high margin ad revenue model is similar to Google’s cash cow Search business.

-

Commissions (30% of e-commerce revenue): merchants pay commissions on transactions through the Tmall network as part of hosting their stores on the largest e-commerce platform in the world. Commission monetization represents ~1% of GMV.

What is the growth thesis for Alibaba China E-Commerce?

The e-commerce market in China is now highly mature with over 50% of retail sales done online and Alibaba maintaining the dominant share. Having been the dominant e-commerce platform in China for the last decade we expect overall growth to slow.

Having said that, we still expect Alibaba to remain the dominant e-commerce platform in China and expect Alibaba’s annual GMV to grow another 50% over the next decade and ad monetization to increase from ~3% to +3.5%.

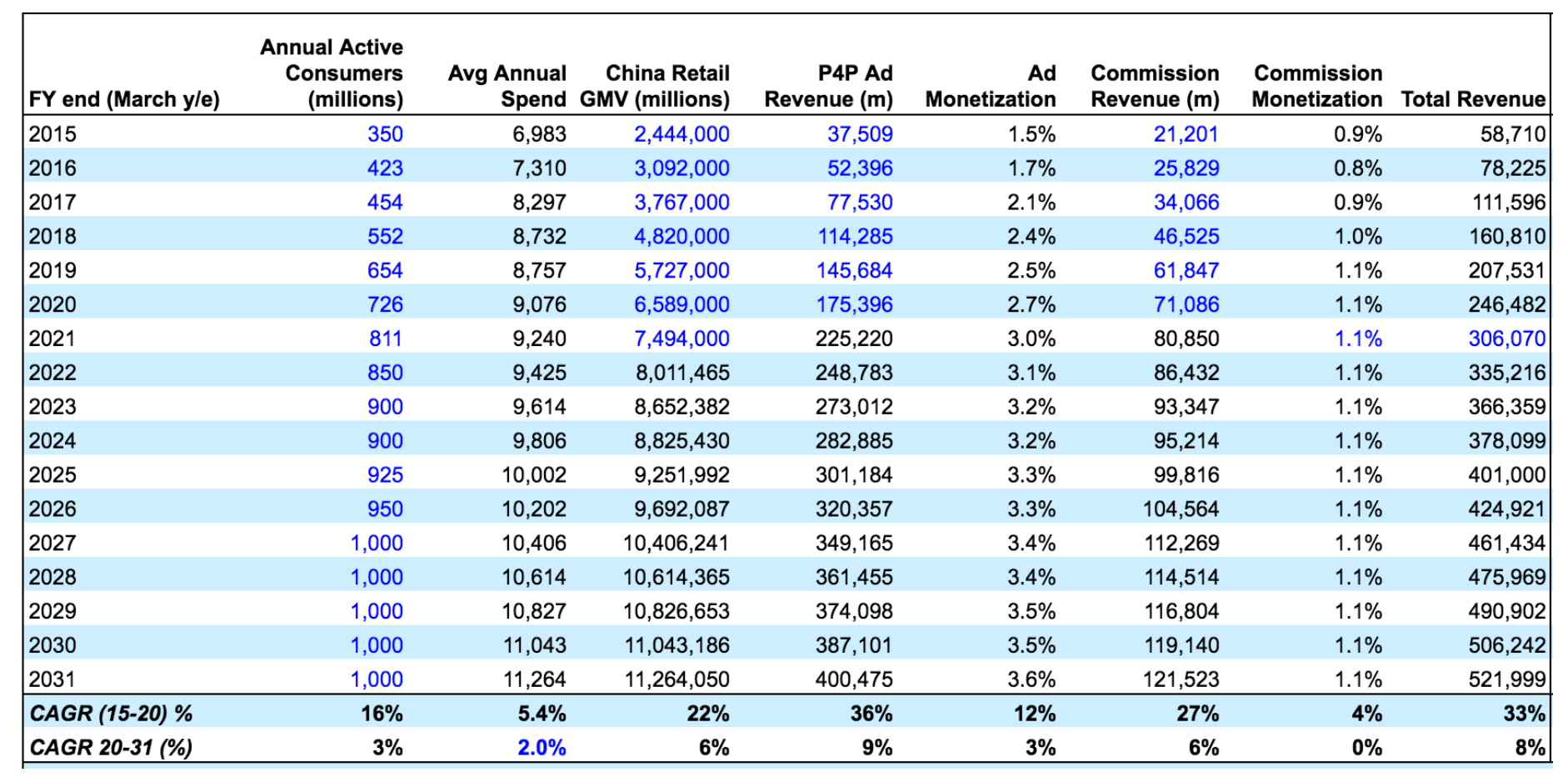

We can represent these assumptions as key operating metrics to arrive at a forecast annual revenue by the end of 2030 of RMB 521bn (US$82 bn), up from ~RMB 300bn (US$47bn) ending 2020.

Alibaba China Retail Marketplace Revenue Model (RMB)

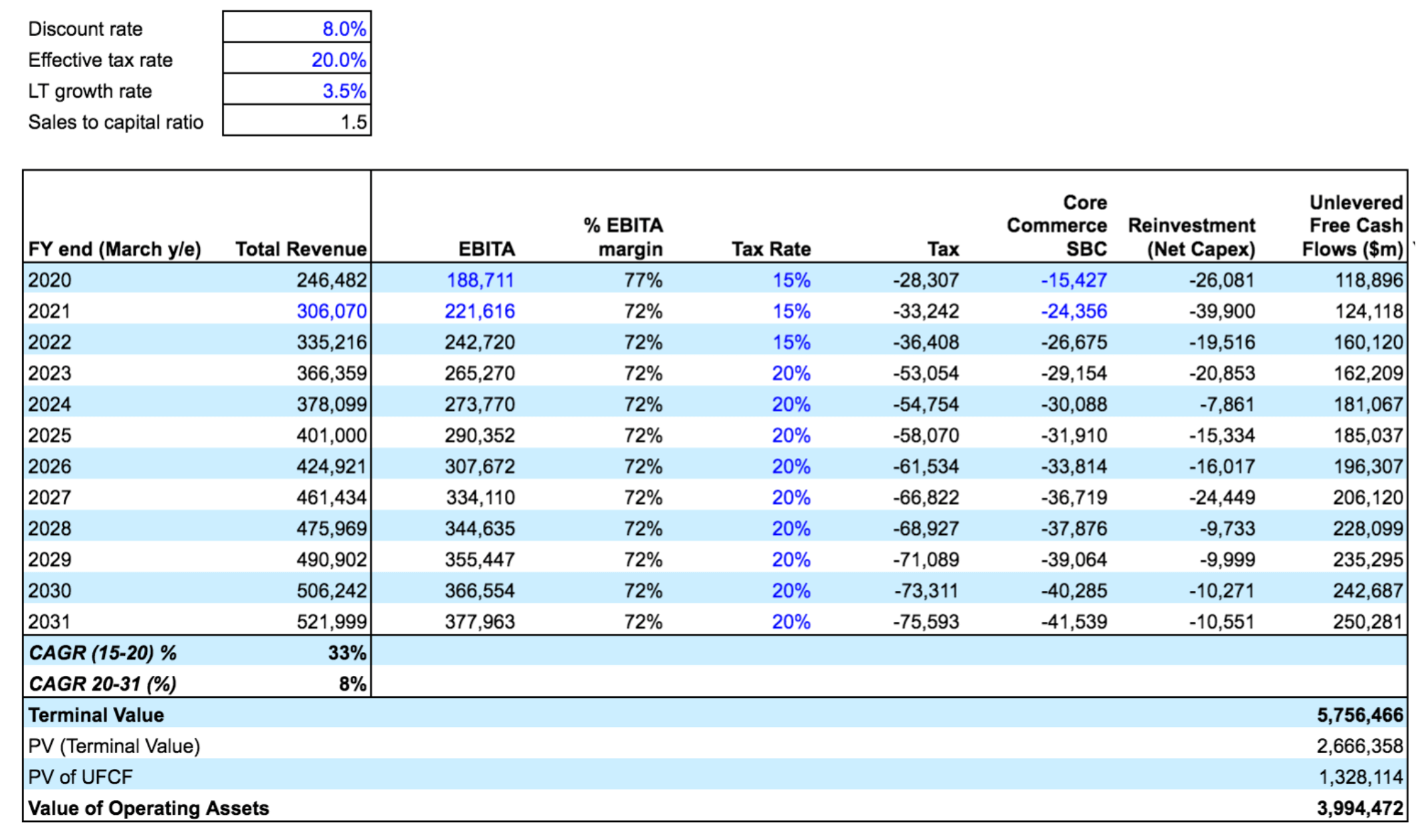

China Retail Marketplace DCF Valuation

We arrive at our RMB 4 trillion ($USD 624 bn) valuation for Alibaba’s China e-commerce business applying the following key assumptions:

- EBITA margins: remain stable at 72% given the high margin operating model of its ad ad and commission businesses. We expect Alibaba’s other segments to operate at break-even largely to support its high margin e-commerce segment (e.g. Cainiao logistics)

- Tax rate: long term effective tax rate of 20% (China based)

- Stock Based Compensation: while non-cash we treat this as an expense as it’s largely a substitute for compensating staff. We expect SBC to remain at 25% of total revenue going forward to attract key talent

- Reinvestment (Net Capex): assume a capital-light sales to capital ratio of 1.5 (in line with Alibaba historical and compares to 1.9 for Alphabet) meaning for every one dollar of incremental annual revenue growth, Alibaba will reinvest 66% back into the business for future growth

- Discount rate: assume 8% discount rate, low by historical standards but higher now given subdued global interest rates

- Long term growth rate: 3.5% above global GDP long term GDP growth of 2-3% as China is still expected to grow faster than the rest of the world for the next decade

Alibaba China Retail Marketplace DCF Model (RMB millions)

3. Alibaba Cloud Valuation

Alibaba’s second most valuable operating segment is its cloud computing business Alibaba Cloud. We conservatively value this segment at RMB 390 billion (~US$60 billion) on the basis it continues to dominate the Chinese market but will face stiff competition globally particularly given political concerns in western economies around hosting of data by Chinese domiciled companies.

What is Alibaba Cloud?

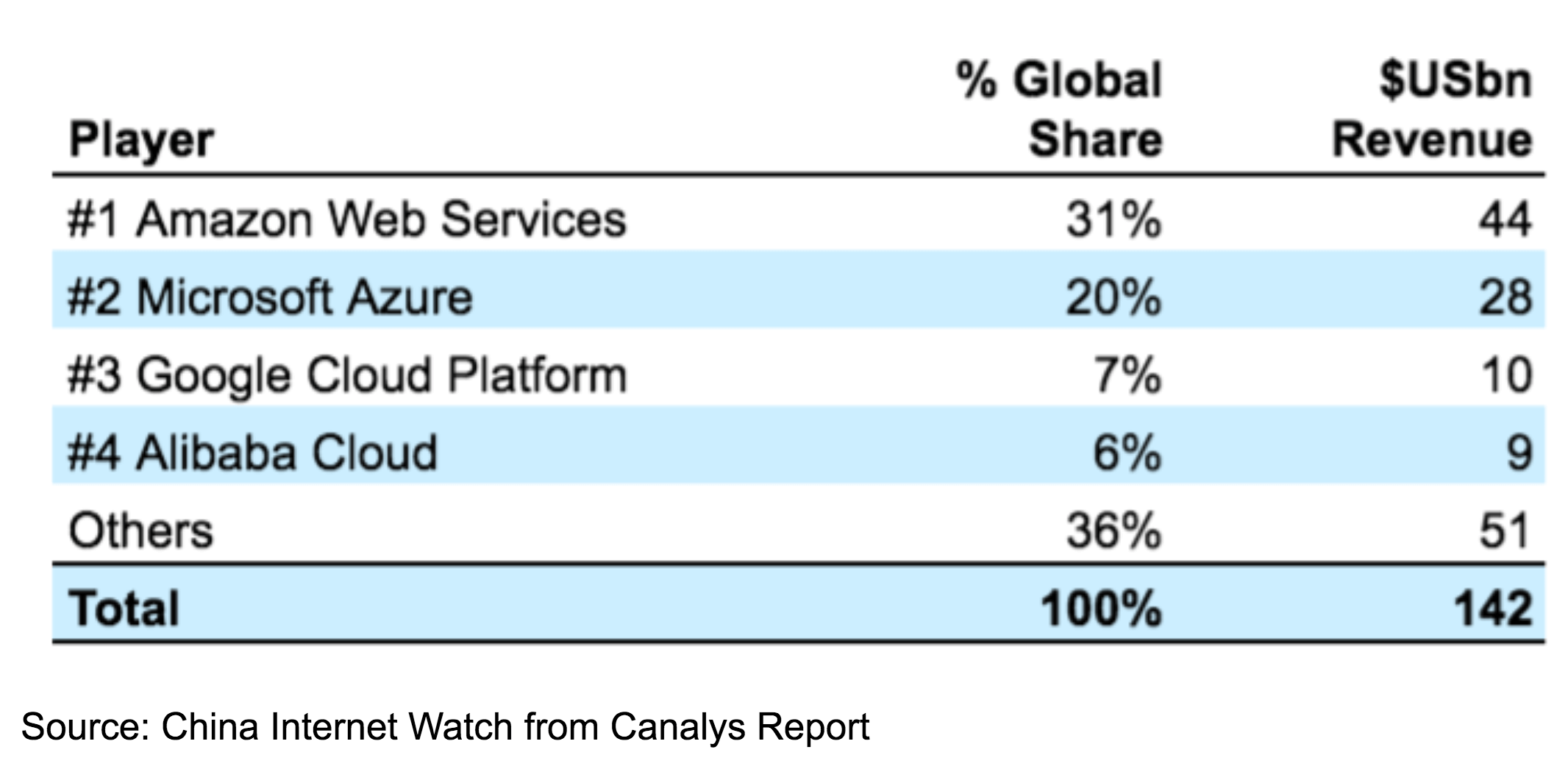

Alibaba Cloud is the 4th largest cloud computing provider globally and the largest in the Asia Pacific with +40% share in China. It sells cloud-based compute and storage infrastructure services to businesses looking to host their applications and data primarily in China (although it operates globally).

Global Public Cloud Infrastructure Services Spend 2020

Alibaba Cloud is similar to Amazon Web Services offering similar competing offers often at even lower prices when hosted in China vs AWS. It has a clear advantage over the other hyperscale cloud providers within China given its significant existing presence in the Chinese market and wider local market support.

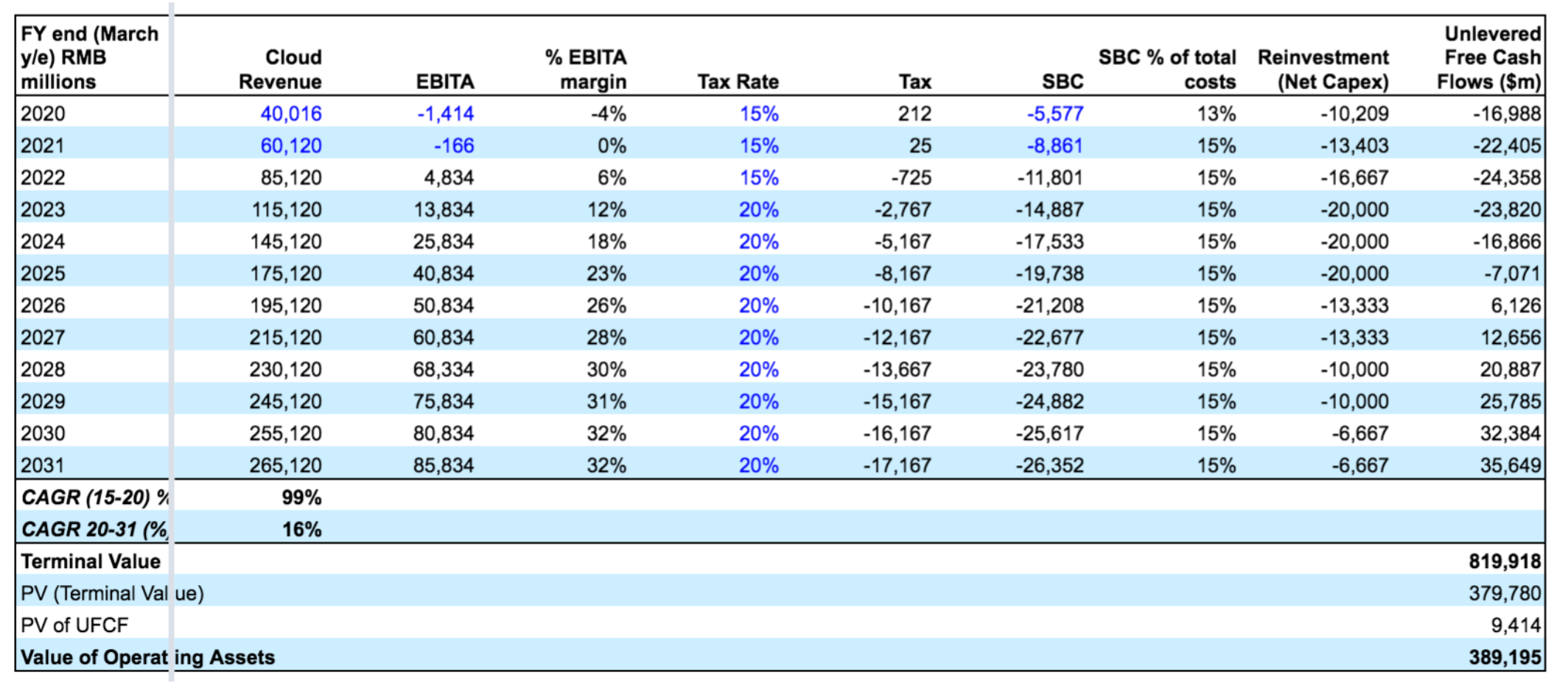

Alibaba Cloud DCF Valuation

Our RMB 390 billion (US$ 60 billion) DCF valuation for Alibaba Cloud is based on the following key assumptions:

- Revenue: Achieve revenues similar to that of current AWS levels by 2030, largely driven by growth in the local Chinese and Asian market. Alibaba is following in the similar footsteps as AWS (~7 years behind) as both the local market leader and without competition from global hyperscale providers. However growth is expected to slow as we expect international growth to be more difficult

- EBITA Margin: Achieve similar EBITA margins of +30% as AWS as it reaches scale and continues to reinvest for growth

- Tax and SBC: Effective tax rate of 20% and lower stock based compensation expense as % of revenues vs Alibaba China Retail as lower proportion of costs represented by people

- Reinvestment Rate: Sales to capital ratio of 1.5 continuing to reinvest 66% of net revenue growth back into the business each year

- Discount and growth rate: 8% discount rate and 3.5% LT growth rate in line with Alibaba China Retail

Alibaba Cloud DCF Valuation (RMB millions)

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.