The Basics of Valuation

4 minute read | May 4, 2019

finance

To understand the principles of valuation, imagine you are presented with an investment proposition.

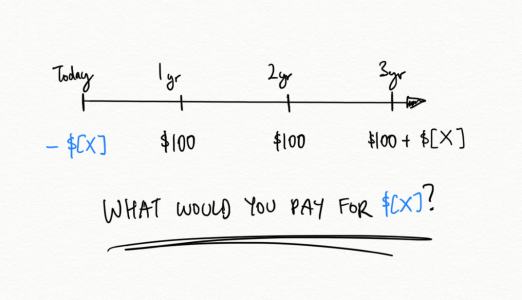

You can purchase a security that pays $100 per year over 3 years. At the end of the 3 year period you will be returned the purchase amount you paid. How much would you pay for this security?

Question: How much would you pay for this security?

To answer this you must ask two questions:

- How sure am I that I will get paid the total $300 plus my original amount?

- What is my opportunity cost of purchasing this versus another investment?

To answer the first question, imagine that the counterparty is a reputable property manager and the cash payments are contingent on them making a profit for each of those 3 years.

The answer to the second question is a personal and subjective one. It is also the most important.

Let’s take two different people:

- Person A has the opportunity to invest in bank term deposits that delivers 5% annual interest. They view the ability of the property manager to achieve profits as medium risk as many tenants are bricks and mortar retail.

- Person B for residency reasons cannot invest in local bank term deposits and can only invest in government bonds that deliver 2% annual interest. They in contrast, trust the track record of the property manager and view it as low risk.

Person A may demand an annual rate of return of 10% given their perceived risk of the business and the comparable opportunity cost of investing in bank term deposits. From this we can calculate that Person A would be willing to pay up to $1,000 for the security (i.e. $100 annual return divided by 10%).

Person B on the other hand may only require a much lower rate of return of 5% given their trust in the property manager and that they do not have the same access to bank term deposits as Person A. Hence Person B would be willing to pay up to $2,000 for the security (i.e. $100 annual return divided by 5%).

Answer: This security is valued between $1,000 to $2,000. It depends on who’s buying.

What is the Discount Rate or WACC?

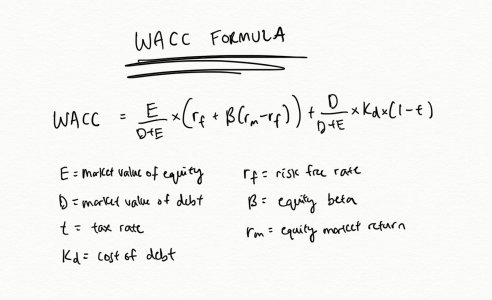

This rate of return is otherwise known as the discount rate or Weighted Average Cost of Capital (WACC) and is used to calculate company or asset valuations. It represents a theoretical aggregation of the rate of return all investors demand from investing in a company (both equity and debt holders).

WACC Formula

Without a discount rate you cannot calculate a valuation or price you should be willing to pay. Of course you can always determine a purchase price based on what you believe someone will pay for it in the future - that’s called speculation.

However, as an individual investor your rate of return is individual to you. Ignore the WACC formula. It is simpler to think of calculating your own discount rate as:

Your Discount Rate = the opportunity cost of investment in something safer + a premium to compensate you for the greater risk and uncertainty.

A Few Complications

In real life valuing companies are more complicated. Cash payments are derived from delivering a product or service of value to customers, managing resources cost effectively and management making good investment decisions. There is no certainty that the business will go on undisrupted in perpetuity. There is no guarantee that the amount you paid will be returned when you decide to sell.

However, the principle remains the same. Effort should be spent on understanding the business, management and industry factors that drive future cash payments. Calculating the valuation is then a simple exercise of discounting those forecast cash payments by your own individual personal, highly subjective required rate of return.

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.