Deprival Super Reaction Bias - Why it makes people go crazy?

3 minute read | Mar 10, 2023

finance, management

Loss aversion bias explains why the pain a person feels from losing $10 hurts more than the pleasure of gaining $10.

People also act irrationally when they lose something they have “almost gotten”. This can hurt more than losing something “already gotten”.

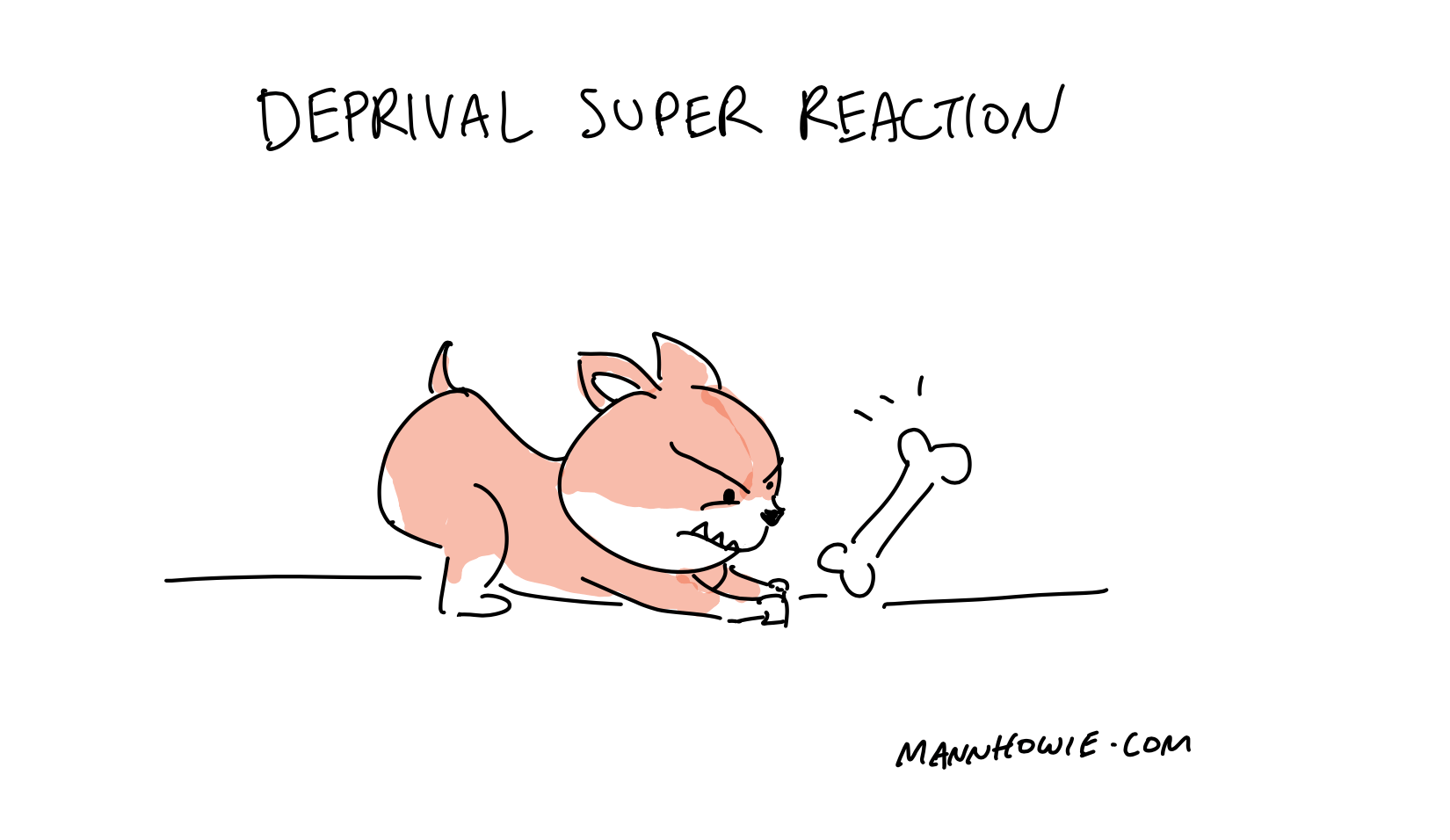

Famous value investor Charlie Munger refers to this bias as the Deprival Super Reaction Tendency and relates it via his family dog:

"Take the Munger dog, a lovely harmless dog. The only way to get that dog to bite you is to try to take some food out of its mouth. Nothing could be more stupid than for the dog to bite his master. But the dog couldn’t help being foolish. He had an automatic Deprival Superreaction Tendency in his nature.

Any of you who have tried to do takeaways in labor market negotiations will know that the human version of that dog is there in all of us.

I mean people are really crazy about minor decrements down.

Huge insanities can come from just sub-consciously over-weighing the importance of what you’re losing or almost getting or not getting.”

Here are three examples of how Deprival Super Reaction bias can affect people and ways to navigate:

1. Losing a promotion

Deprival Super Reaction bias can cause major disputes amongst managers and employees during salary and career discussions.

An employee who has an indication of a salary increase or promotion can become enraged and demotivated if they don’t get it.

An employee seeing others get out of cycle salary increases and promotions can be led to believe that the squeaky mouse gets the cheese and can feel betrayed.

How to navigate? Managers must beware the severe consequences of over-promising and under-delivering in career development and labour negotiations. Be transparent and set clear expectations if there are hiring or salary freezes.

2. Holding on to falling stock

Investors may experience Deprival Super Reaction bias by holding on to a stock which had previously increased but has subsequently plummeted.

When stock investments rise people feel like the smartest people in the room. Once they fall, people can feel hurt and cheated of their unrealised gains. It can then be irrational not to sell, as there may be tax benefits from realising the loss.

How to navigate? Focus on the fundamentals of the business. If a stock has subsequently fallen, revalue the asset based on latest information. View your holding from the perspective of a new investor and ask yourself if you would invest in it today compared to other opportunities (stocks, bonds, cash).

3. Overvaluing ideas

The IKEA Effect explains how we tend to overvalue things we place successful effort into. Our Deprival Super Reaction tendency can cause us to feel hurt and breed resentment to people who dismiss or overlook those ideas.

How to navigate? Treat your ideas like cattle not pets and be ready to cull them not coddle them. Create a workplace that encourages an idea meritocracy where the best ideas float from the front line to the top and where the idea wins not the person who sponsored it.

References

- The Psychologies of Human Misjudgement (transcript) - Charlie Munger Harvard University speech 1995

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.