Why Invest in Exchange Traded Funds (ETFs)?

6 minute read | Apr 6, 2022

finance

Exchange Traded Funds (ETFs) are listed funds that commonly track a basket of securities linked to major indices. Most ETFs are passive equity index funds that track major stock market indices. The world’s top 5 ETFs represent over USD1.5 trillion in assets under management:

| ETF Fund | Assets USDbn | Index |

|---|---|---|

| 1. State Street SPDR S&P 500 ETF | 416 | S&P 500 |

| 2. Blackrock iShares Core S&P 500 ETF | 335 | S&P 500 |

| 3. Vanguard S&P 500 ETF | 293 | S&P 500 |

| 4. Vanguard Total Stock Market ETF | 292 | CRSP US Total Market Index |

| 5. Invesco QQQ Trust | 197 | NASDAQ 100 |

Source: ETF Database

This article explains why people invest in ETFs, how they work, why they trade close to Net Asset Value and how they differ vs actively managed mutual funds.

1. Why Invest in ETFs?

People are attracted to investing in ETFs as a low cost way of gaining exposure to the entire market economy vs picking individual stocks.

For long term investors, individual stock picking is a bet that a company will remain great over the long run. This is not an easy task, as famous value investor Mohnish Pabrai says “Capitalism is Brutal”.

Consider that today, 2/3rds of companies in the Dow Jones Industrial Average were not represented 30 years ago, and only one company still remains when looking back 45 years (Procter and Gamble) source.

A passive investment in an index such as the S&P 500 is a bet that the top 500 companies listed on US exchanges combined will be more valuable in the future than they are today.

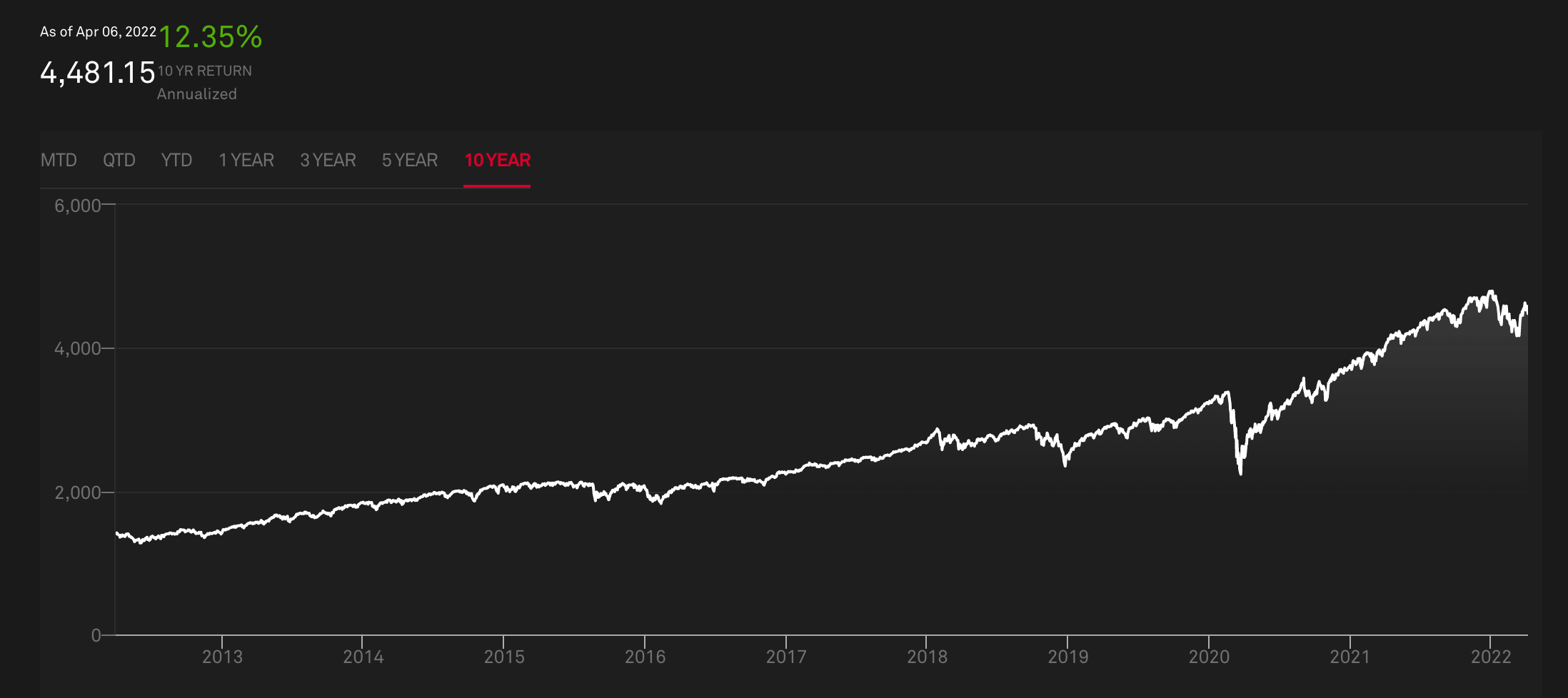

Over the past 10 years, the S&P 500 index combined market cap has grown from ~US$12 trillion to +US$40 trillion achieving an annualised return of +12%. This period has been characterized by major disruption with the technology sector displacing the financial and commodity sector as the key drivers of growth.

S&P 500 Index 10 Year Performance

Source: SPGlobal

Source: SPGlobal

Whether the next 10-20 years is driven by AI, robotics or even the agriculture sector should not matter for passive index investors, so long as the overall economy and company earnings grow.

2. How do ETFs work?

To understand how ETFs are created imagine we are establishing an equity index ETF which will track the performance of the top 5 largest US listed companies (a fictional S&P Big 5 Index).

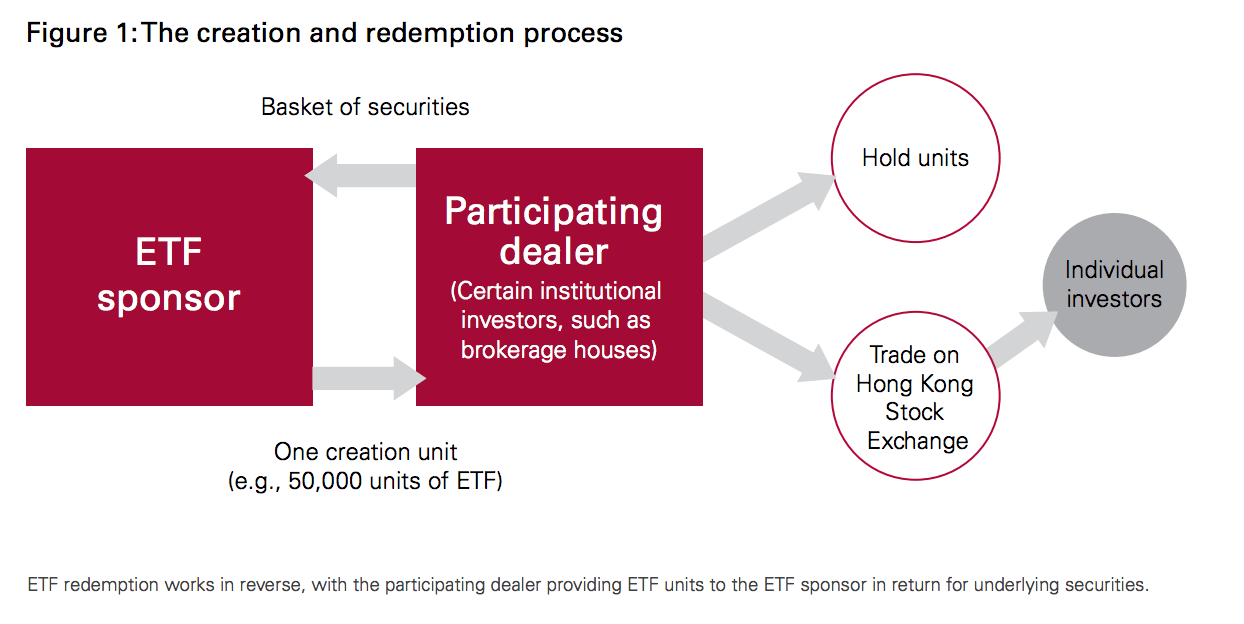

The creation of an ETF involves 3 parties:

- ETF Sponsor (eg Vanguard)

- Participating Dealer (eg Citigroup)

- Individual Investors (eg retail investors)

ETF Creation and Redemption Process

Source: Vanguard

Source: Vanguard

Stage 1

We start with our ETF Sponsor Vanguard who begins marketing the idea of an S&P Big 5 ETF. They engage Citigroup as a Participating Dealer to go out to their investors to gauge interest for this new ETF.

Investors express strong demand in the fund and Citigroup sees a business opportunity to act as a broker and trade these ETFs for their investor clients to earn a commission.

Stage 2

Citigroup goes into the stock market and starts buying up parcels of shares of the S&P Big 5 constituents in the same weight as the index on behalf of their investor clients.

They then take these newly acquired shares to the ETF Sponsor Vanguard and exchange them for a parcel of ETF shares. Vanguard having received these physical shares creates new parcels of ETF shares to give to Citigroup. This is known as the creation process in the primary market for ETFs.

Stage 3

Citigroup now sells these newly created ETF shares to their investor clients via the stock exchange who want the convenience of a single ETF share that has the underlying holding of the index shares. This happens in the secondary market for ETFs (being the listed exchange).

Investors can then buy and sell these newly created ETFs on the secondary market. As demand outstrips supply, Citigroup can once again buy the underlying shares and go into the primary market and request more ETF shares be created in exchange for the acquired shares.

In this way, ETF shares on issue can continue growing without the need for the fund to engage in costly capital raising activities like other managed/ mutual funds or listed investment companies.

3. ETF Share Price vs NAV

ETF share prices trade very closely to their underlying Net Asset Value (NAV). The NAV is the value of the underlying shares less the fund’s expenses. This occurs because of arbitrage in the primary and secondary market.

Imagine if the ETF share price were to trade at a 50% discount to its NAV. A participating dealer could buy up the ETF shares and take them to the fund and ask for them to be redeemed for their underlying shares. The ETF Sponsor would accept and then cancel the ETF shares and then transfer the underlying shares to the Participating Dealer. The dealer would then sell these shares at market value and pocket the 50 % profit. This would continue bidding up the ETF share price until it reached close to NAV.

Similarly if the ETF share price was trading at a 20% premium to NAV. The Participating Dealer would buy the underlying shares in the market, exchange them for newly created ETF shares in the primary market and then sell them in the secondary market to pocket a 20% profit. They would continue doing this and selling ETF shares until the price fell close to NAV.

3. ETF vs Managed Funds?

The primary difference between ETFs and Managed Funds are that ETFs are typically a low cost passive index play with high liquidity vs Managed Funds being higher cost active stock picking play with lower liquidity.

ETF fee structures can be as low as a fixed annual management fee of 0.2% vs Managed Funds being 1.0% annual management fee plus 20% performance fee above market returns.

ETFs are able to achieve a lower fee structure as they have no active internal or third party headcount focused on investment analysis and there is no active trading or capital raising function (that is done via Participating Dealer).

Managed Funds are also often close-ended and unlisted meaning during downturns investor redemptions can negatively impact returns as they are forced to sell underlying shares to realise losses. This also puts upward pressure on expense ratios as assets under management decline.

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.