Principal Agent Problem - 4 Real Examples & Solutions

8 minute read | Feb 23, 2024

finance, product, management

The principal-agent problem is an economic theory explaining why someone would not act in the best interest of the person who delegated responsibility to them.

It happens when there is a conflict between the desires and goals of the two parties and when it is difficult to monitor what the delegated person is actually doing.

It happens when there is a conflict between the desires and goals of the two parties and when it is difficult to monitor what the delegated person is actually doing.

It is a common challenge that comes up in everyday life, finance and running businesses. This article explores four real world examples and how they solved the principal-agent problem.

- Convict transport - Australian penal colony

- Accommodation - AirBnB ratings

- Investing - Buffett partnership

- Sustainability - Green buildings

1. Convict transport: How to stop ship captains killing passengers?

In the 1700s, private contractors were responsible for the transportation of British convicts to Australian and American penal colonies.

The principal, being the British government, cared about solving both prison overcrowding as well as the welfare of transported convicts. Contractors, acting as agents, cared about maximising profits and the number of transport voyages.

Passenger health was abysmal and death rates were high.

The British government could only afford a single naval agent to be on board and if the ship had a surgeon he answered to the contractor’s ship captain. The cost of monitoring passenger welfare was high and public support for convict health was low.

Solution

The solution to this problem came in the form of changing the government fee structure. According to an 1862 speech by British economist Edwin Chadwick

Instead of contracts being made for the numbers embarked, payment was contracted for each person landed alive. This opened the eyes of shippers and they engaged medical men and gave them means. The result was a reduction of sickness and mortality to 1.5%. Economy beat sentiment and benevolence.

2. Accommodation: How to make guests respect property?

Property damage, excessive use of consumables and theft is a real cost for hotels and hosts of holiday homes.

The principals, being hotels and hosts, care about protecting their property and furnishings for future rental income and resale value. The agents, being guests on holiday, care about relaxing, indulging and performing as little chores as possible.

Hotels try to solve this problem with credit card deposits, limiting consumables and performing room inspections. This is costly to monitor, enforce and doesn’t solve the problem of common areas.

Solution

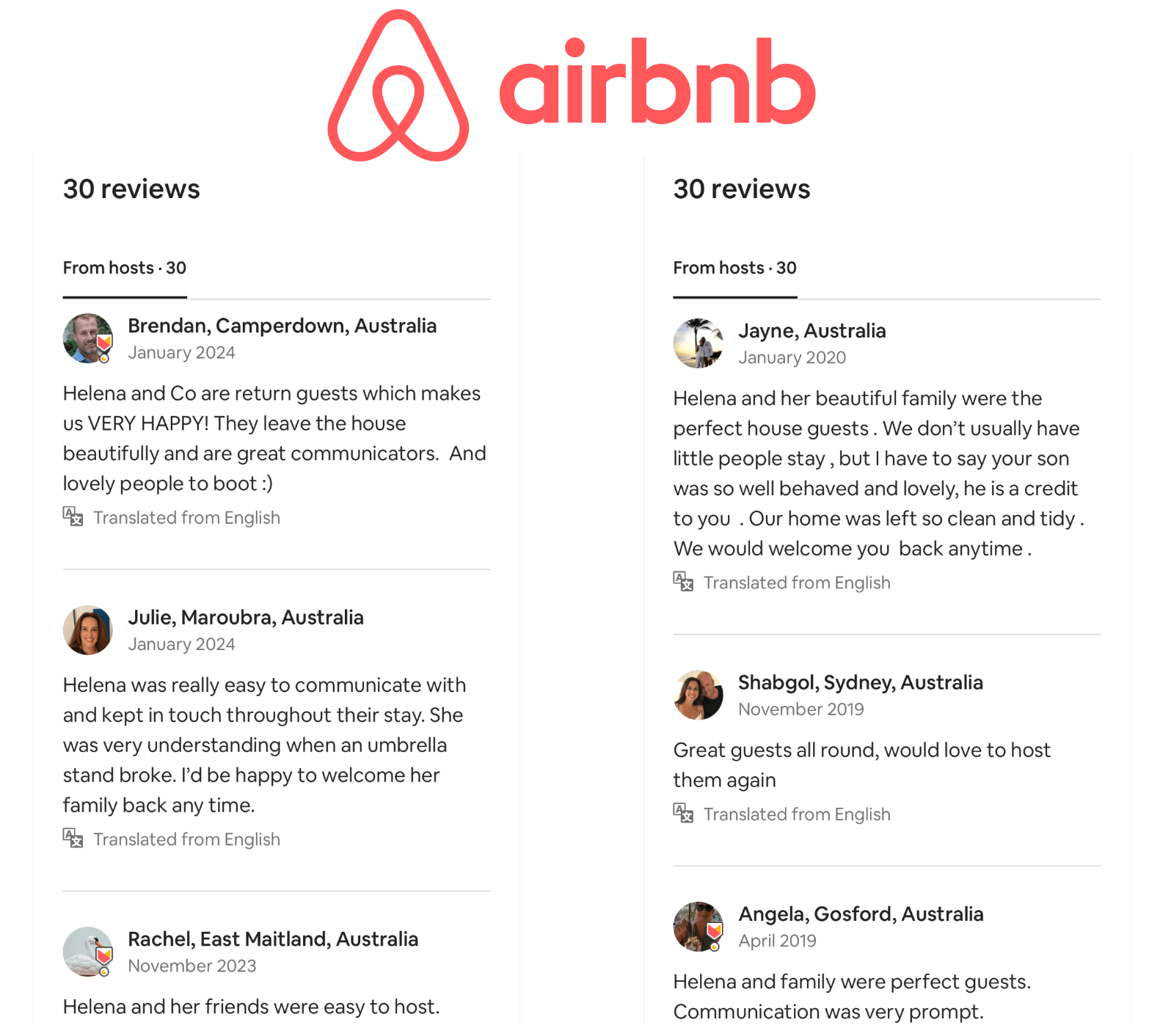

AirBnB had a better product solution to this principal-agent problem: Accountability in the form of “Two-way ratings”. At the end of each stay, both host and guest are asked to submit a rating and review of each other. Both parties can only see the other’s review once they have first submitted theirs, this encourages high uptake as well as honesty and civility.

Guests have a host review profile that lets future hosts check before deciding to accept them as a guest. This creates accountability and encourages guests to be on their best behaviour.

My wife is an amazing AirBnB guest.

3. Investing: How to stop a fund manager from scraping off the top?

In the world of finance, incentive alignment between investors and their fund managers is a difficult challenge.

The principal, being the investor, cares about earning steady above market returns for a long period of time. The fund manager, as their agent, cares about maximising near term profits and growing their assets under management to grow even more profits.

The typical fee hedge fund manager fee structure is 2/20. Meaning they charge an annual 2% fee for funds under management and a 20% share of any annual profits. The performance fee is designed to align incentives, as it is too difficult for the investor to monitor whether the fund manager is doing the best research and making the best investment decisions on their behalf.

But, the typical 2/20 fee structure creates two problems for the investor:

- 2% management fee means the fund manager is motivated to spend their time attracting other investors instead of focusing on long term investment opportunities

- 20% performance fee means the fund manager shares in any profit upsides but not on the downside

Solution

Warren Buffett attempted to solve this principal-agent problem in his early Buffett partnership by introducing the 0/6/25 fee structure. It works like this:

- 0% management fee for assets under management

- 6% high-water mark hurdle rate, meaning no performance fees can be earned until at least this cumulative annual return has been met

- 25% performance fee (which is above market) on profits but only above the 6% high-water mark

This means the fund manager is focused on long term investment opportunities instead of fund-raising and must make up for any below market returns and losses before earning a high performance fee.

As Charlie Munger says about the Buffett partnership fee structure:

I think it is fair and I wish it was more common. I basically don’t like it where they’re just scraping it off the top. And if you’re pretty rich why shouldn’t you put your money alongside your investors? And go up and down with them. And if there’s a bad stretch, why should you scrape money off the top when they’re going down?

4. Sustainability: How to stop property managers wasting energy?

In the world of commercial property, building owners engage property managers to handle the day to day leasing, operation and maintenance of their assets.

The principal, being the owner, cares about maximising the energy efficiency of their buildings and reducing outgoings. The agent, being the onsite property manager and first in line to handle tenant complaints, cares about reducing complaints and having enough time to manage all maintenance duties.

Problems arise when property managers run equipment harder than needed in response to reducing or avoiding tenant complaints which increases utility costs and increases capex replacement costs.

It is too difficult and costly for owners to monitor the day to day decisions property managers make as well as understanding whether increases in utility and maintenance costs are avoidable.

Solution

The Australian commercial property industry has solved this principal-agent problem through mandatory sustainability ratings. Buildings are rated annually on a 1 to 6 star scale measuring their energy and water efficiency as well as indoor environment quality. Owners commonly tie property management performance targets to these ratings and can withhold a portion fees if targets are not met without explanation.

By making the sustainability ratings mandatory, transparent and easy to understand it transformed the behaviour of property managers to consider sustainability consequences in their day to day decision making.

Summary

Principal-Agent Problem - Real world examples and solutions

| Example | Principal | Agent | Consequence | Solution |

|---|---|---|---|---|

| 1. Convict transport | English court cares about reducing prison overcrowding by sending convicts to the Australian penal colony | Ship captain cares about maximising profits and number voyages | Low survival rate of convict passengers making the voyage | Remuneration model: Pay for convicts who disembark the ship vs board the ship |

| 2. Accommodation | Hotel or host cares about protecting their property and furnishings | Guest cares about relaxing, maximising enjoyment and doing little work | Property damage, excessive use of consumables and theft | Accountability: AirBnB “two-way rating system” for hosts and guests |

| 3. Funds management | Investor cares about steady above market returns over the long term | Fund manager cares about growing near term profits and assets under management | Skewed returns, where fund manager shares in investor’s profits but not losses | Risk sharing: Buffett partnership 0/6/25 high-watermark fee structure |

| 4. Sustainability | Property owner cares about energy efficiency and reducing maintenance outgoings | Property manager cares about reducing frequent tenant complaints and breaching lease agreements | Energy waste, equipment overuse, high utility bills and earlier capex replacement | Benchmarks: Set sustainability rating targets, financial penalties if not met |

Reference:

- Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure

- Hyman, D. (1999). Convicts and convictions: some lessons from transportation for health reform

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.