How to treat stock compensation when valuing companies?

4 minute read | Jan 19, 2024

finance

Most investors ignore stock compensation as a cash expense, which causes overvaluation of share prices - over 70% of equity analysts fail in this regard.

1. What's the problem with stock compensation?

Many companies offer employee equity remuneration in the form of stock options and restricted shares. This is known as stock-based compensation (SBC) and is shown as an expense on the income statement

The company wins by saving on cash to invest elsewhere. Employees win by sharing in the upside if the company does well. Shareholders win by aligning employee incentives.

As a result, management often excludes it from their earnings figures as a non cash expense, highlighting Adjusted EBITDA instead of operating profit.

But is stock-based compensation truly free? No. The company will either have to spend cash repurchasing shares from the open market or dilute the ownership of existing shareholders.

As Charlie Munger says:

I think that every time you see the word EBITDA, you should substitute the words “bullshit earnings”

2. How material is stock-based compensation?

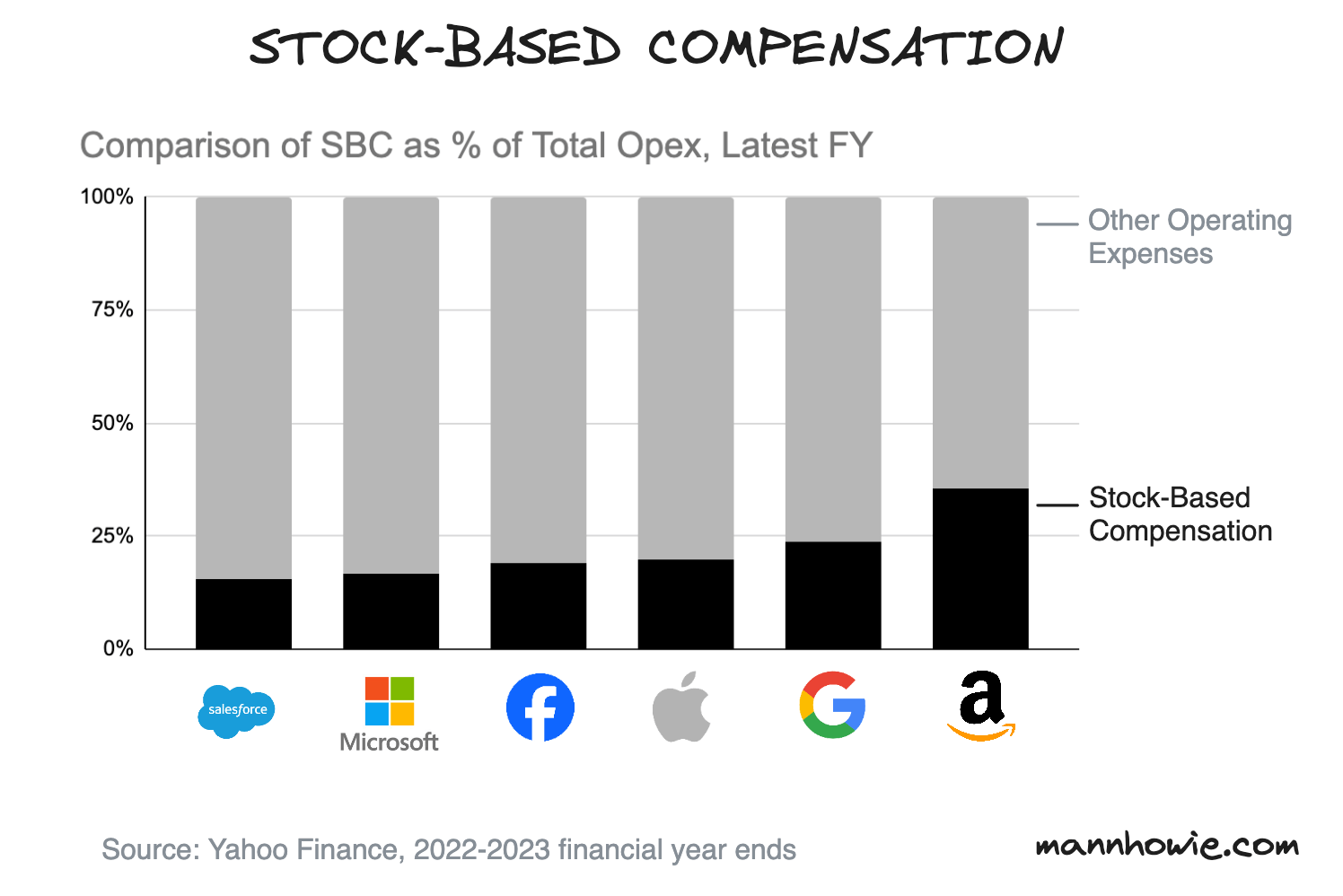

Stock-based compensation (SBC) can be material for early stage, technology and professional services firms. Up to 35% of fixed operating costs is common to see amongst tech firms.

For Facebook owner Meta, SBC expenses make up 19% of its total operating expenses. Over the past three years, Meta on average reported +$9bn a year in non-cash SBC expenses and spent +$26bn a year in cash on stock buybacks to return capital plus offset dilution from SBC programs.

3. How does stock-based compensation dilute existing shareholders?

Let's explore a simple example.

Assume you own 50% of a company valued at $1m, with 1m shares outstanding at $1.00 per share.

The CEO you hired needs to offer up to 17% of the company to attract the best tech talent in the form of additional equity compensation. You explore two scenarios.

Scenario 1 - Issue new equity stock options

The company issues up to 200k new equity stock options and grants this to tech talent over a 4 year vesting period. There is no upfront cash expense.

Once vested the share count will grow from 1 to 1.2m shares. This dilutes your direct ownership in the company to 42% and reduces the value of the share price from $1.00 to $0.83 per share. The new tech talent will own up to 17% of the company.

You win by saving on cash today, but lose by reducing your future ownership in the firm.

Scenario 2 - Purchase existing stock with cash on behalf of talent

The company purchases stock in the market making up to 17% of the company at $1.00 per share. Up to $170k in company cash is spent purchasing 170k shares, this is reserved as restricted shares for the tech talent over a 4 year vesting period.

No new shares are issued so the share count stays at 1m shares. Your ownership remains unchanged at 50% of the company.

You lose by spending more cash today, but win by avoiding ownership dilution in the firm.

4. What is the solution to include the impact of stock-based compensation in company valuations?

Treat SBC as akin to an actual cash expense (preferred approach) or arguably more difficult, account for the cumulative future impact of issuing more shares.

When valuing a company using the DCF approach, exclude SBC from un-levered free cash flows. Forecast SBC as either a percentage of forecast revenues, employee wages or operating expenses.

Here is an excellent article with a financial model comparing the valuation impact of treating SBC as a cash vs non cash expense - Stock Based Compensation in DCFs.

References

- Stock-based Compensation, Financial Analysts, and Equity Overvaluation, Columbia Law School - Study reviewed 585 equity analyst reports and found 356 ignored SBC as an expense in valuation reports, 148 treated it as an expense and the remainder unclear.

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.