What is the Time Value of Money with Examples - 4 Elements of TVM

3 minute read | Sep 10, 2022

finance

In understanding the concept of the Time Value of Money (TVM) we can expand and answer Aesop’s 600BC fable:

“When are two birds in the bush worth more than one in the hand?”

Warren Buffett in his 2000 annual shareholder letter answered Aesop’s fable by answering four questions:

- Future value: How many birds are there in the bush?

- Certainty: How certain are you that there are indeed birds in the bush?

- Time periods: When will they emerge?

- Annual rate: What is the risk free interest rate?

Future value

In answering the first question of future value we are told there are two birds from the bush that will be captured for us.

Certainty

In terms of certainty we can be fairly certain that the species of birds is not extinct or endangered and the hunters have the means of capturing them.

Time periods

To answer when they will emerge we will need to assess how long it will take the hunters to capture them after deducting for their costs and supplies.

Annual rate

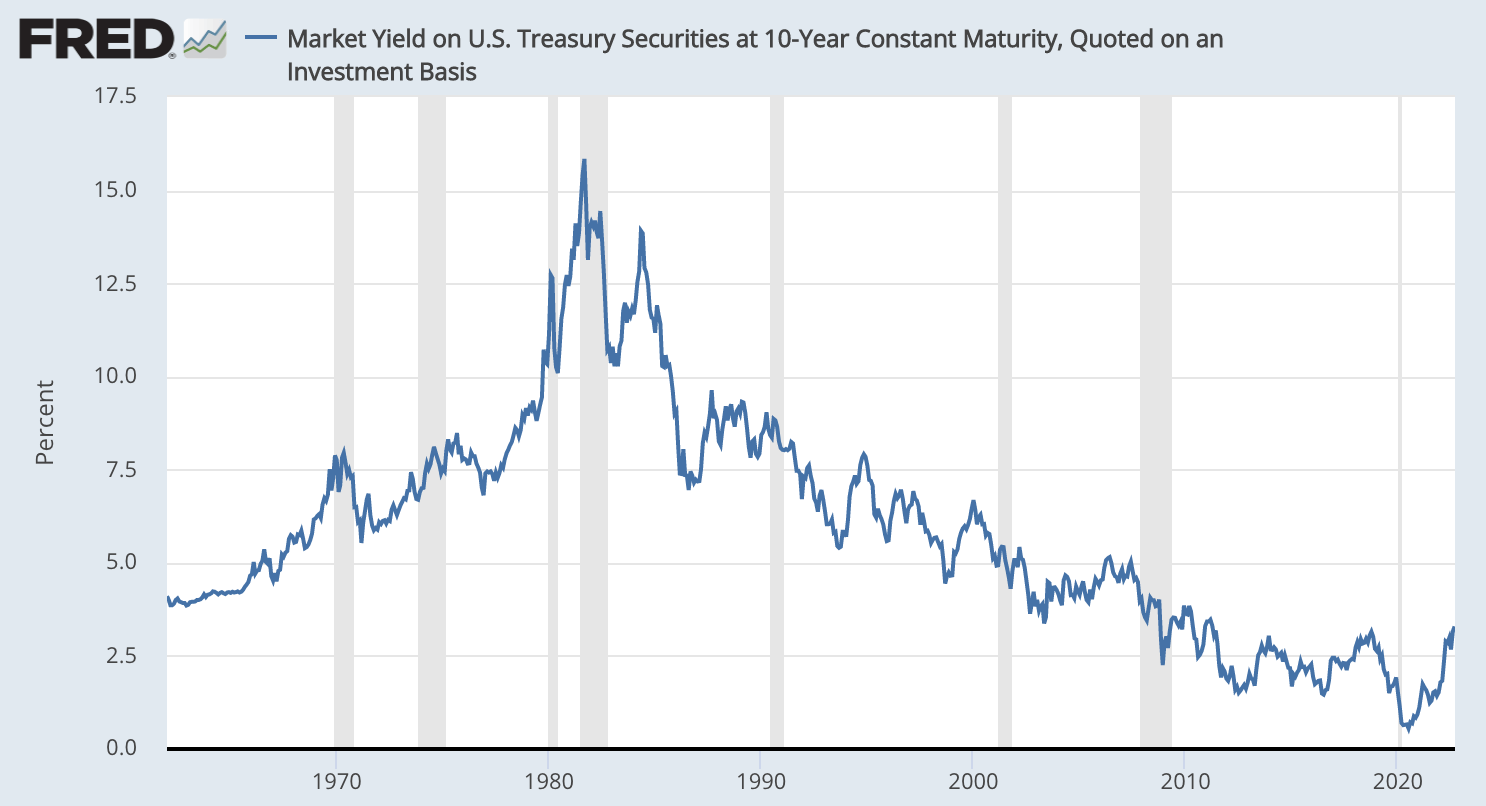

To assess the present value of the opportunity we need to look at the risk-free interest rate which we can consider to be the yield on long-term US bonds. This rate represents the expected low-risk return we would receive for investing our current bird in the hand if exchanged for dollars - also known as our opportunity cost.

US long-term treasury yield rates

Source: Board of Governors of the Federal Reserve System (US)

Present value

If we answer these four questions we will know the maximum number of birds we possess today that should be offered to invest for the promise of two birds in the bush.

Scenario A - High interest rates If we are in a high interest rate environment of 15% (as in the 1980s) and we expect to receive two birds from the bush in 5 years then we should exchange our bird in the hand. Any longer than 5 years then we should keep our bird in hand.

Investing our one bird in the hand at a 15% compound rate over 5 years would yield us 2 birds.

Scenario B - Low interest rates But if we are in a low interest rate environment of 3% (as in the 2010s) and we can still get two birds out in 20 years it still makes sense for us to give up our bird in the hand.

Aesop’s fable expanded and converted from birds to dollars applies to any financial investment whether it be for stocks, bonds, commodities, farm output and rental property.

Want more tips?

Get future posts with actionable tips in under 5 minutes and a bonus cheat sheet on '10 Biases Everyone Should Know'.

Your email stays private. No ads ever. Unsubscribe anytime.